Cfo Company Vancouver Things To Know Before You Buy

Wiki Article

The 10-Minute Rule for Virtual Cfo In Vancouver

Table of ContentsThe Buzz on Pivot Advantage Accounting And Advisory Inc. In VancouverThe Vancouver Tax Accounting Company Statements4 Easy Facts About Small Business Accounting Service In Vancouver ExplainedThe 8-Minute Rule for Tax Consultant VancouverThe Definitive Guide for Cfo Company VancouverFacts About Vancouver Accounting Firm Uncovered

Below are some benefits to working with an accountant over a bookkeeper: An accountant can provide you a thorough sight of your company's economic state, in addition to approaches and suggestions for making financial decisions. On the other hand, bookkeepers are only in charge of videotaping monetary purchases. Accounting professionals are required to complete more schooling, accreditations and also job experience than accountants.

It can be hard to gauge the suitable time to hire an accounting professional or bookkeeper or to establish if you need one whatsoever. While lots of local business hire an accounting professional as an expert, you have numerous alternatives for handling financial tasks. As an example, some small company proprietors do their very own accounting on software their accounting professional advises or uses, providing it to the accounting professional on a regular, regular monthly or quarterly basis for activity.

It might take some history research study to discover a suitable bookkeeper due to the fact that, unlike accounting professionals, they are not called for to hold a specialist accreditation. A solid endorsement from a relied on colleague or years of experience are essential aspects when hiring an accountant.

Some Ideas on Virtual Cfo In Vancouver You Should Know

:max_bytes(150000):strip_icc()/Accounting-error-4202222-recirc-FINAL-30dfa8eb28224cfb9ef63a72f5eaa5e8.png)

For local business, skilled money management is a vital element of survival and also development, so it's smart to deal with a financial professional from the beginning. If you favor to go it alone, consider beginning with accounting software program as well as keeping your publications carefully up to day. By doing this, need to you need to work with a specialist down the line, they will have presence right into the complete monetary background of your business.

Some source meetings were carried out for a previous variation of this post.

The smart Trick of Pivot Advantage Accounting And Advisory Inc. In Vancouver That Nobody is Talking About

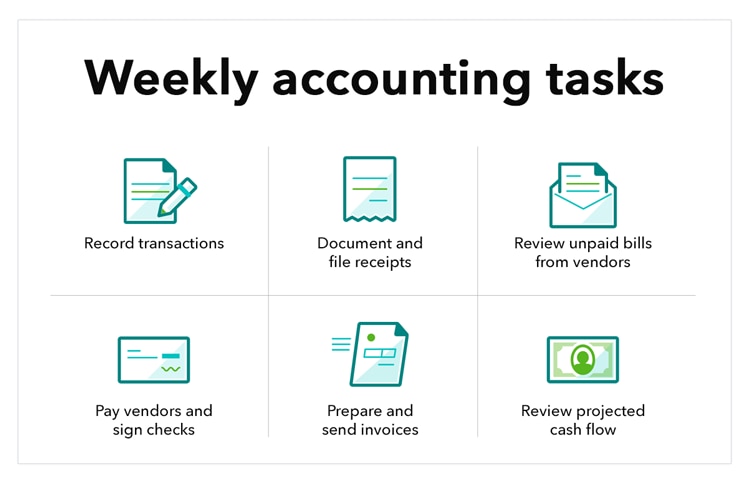

When it concerns the ins as well as outs of taxes, bookkeeping and financing, however, it never ever harms to have a seasoned specialist to count on for advice. A growing variety of accountants are also dealing with things such as capital forecasts, invoicing and also HR. Ultimately, numerous of them are taking on CFO-like functions.Local business owners can expect their accountants to aid with: Choosing the service framework that's right for you is necessary. It influences exactly how much you pay in tax obligations, the documentation you need to file as well as your personal liability. If you're wanting to convert to a different organization framework, it could result in tax repercussions as well as weblink other complications.

Even firms that are the same size and also industry pay extremely various amounts for bookkeeping. These costs do not convert right into cash, they are necessary for running your company.

3 Simple Techniques For Vancouver Accounting Firm

The average cost of accounting services for tiny company varies for each distinct circumstance. The average regular monthly bookkeeping charges for a small business will rise as you add extra solutions and the jobs obtain more challenging.You can tape-record purchases and procedure pay-roll making use of online software. You enter quantities into the software application, and the program calculates overalls for you. In many cases, payroll software program for accountants enables your accountant to provide payroll handling for you at extremely little extra price. Software remedies come in all forms and dimensions.

How Small Business Accountant Vancouver can Save You Time, Stress, and Money.

If you're a new company owner, do not forget to you can try these out factor bookkeeping expenses right into your budget. If you're an expert proprietor, it could be time to re-evaluate audit prices. Management expenses and also accountant fees aren't the only accountancy expenditures. tax accountant in Vancouver, BC. You need to likewise consider the results accountancy will have on you and also your time.Your capability to lead workers, serve consumers, and also make decisions might suffer. Your time is likewise useful as well as must be taken into consideration when taking a look at audit prices. The time spent on accountancy jobs does not produce revenue. The less time you invest in bookkeeping and taxes, the more time you need to grow your organization.

This is not meant as lawful advice; to learn more, please click on this link..

you can try here

How Virtual Cfo In Vancouver can Save You Time, Stress, and Money.

Report this wiki page